Everything about Mortgage Broker

Wiki Article

All About Mortgage Broker

Table of ContentsWhat Does Mortgage Broker Average Salary Do?Get This Report about Mortgage BrokerageWhat Does Mortgage Broker Average Salary Mean?5 Easy Facts About Mortgage Broker Assistant ExplainedAll about Mortgage Broker AssociationMortgage Broker Vs Loan Officer Fundamentals ExplainedThe Of Mortgage Broker AssistantFacts About Mortgage Broker Job Description Uncovered

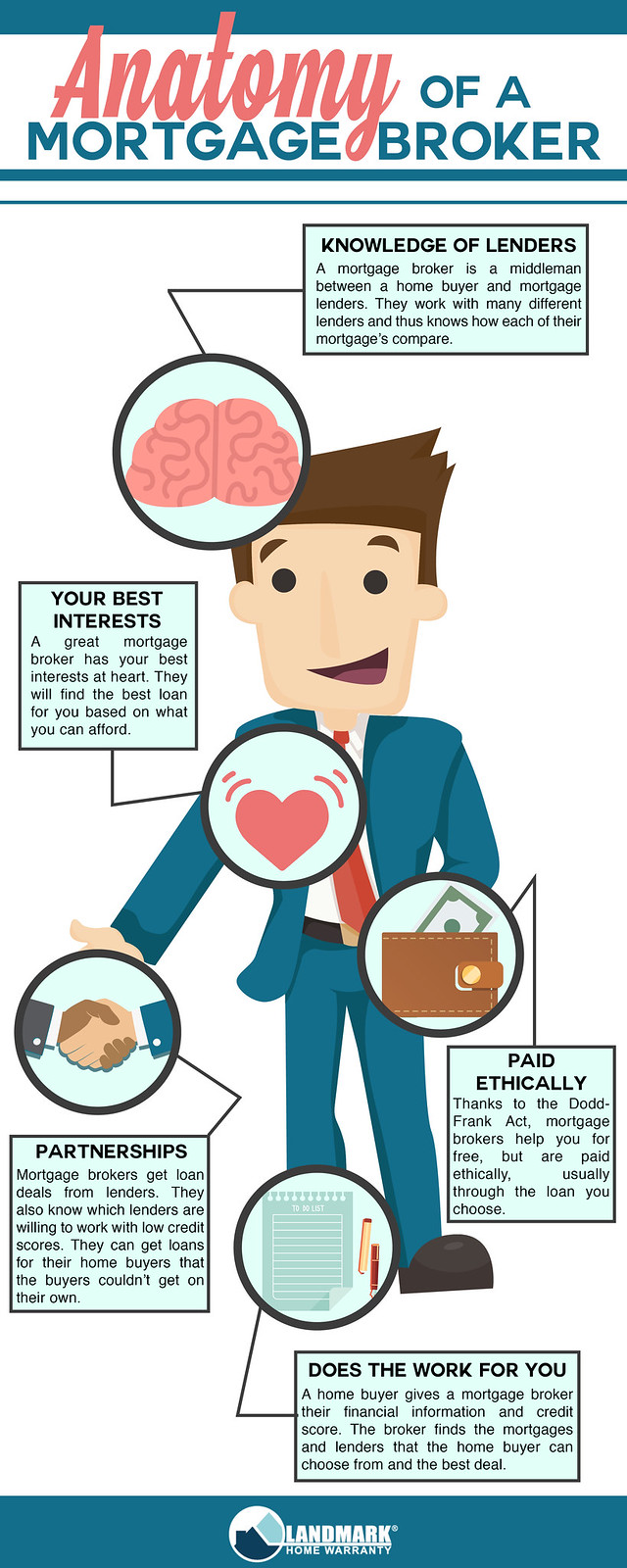

A broker can compare financings from a financial institution and also a credit rating union. According to , her very first obligation is to the organization, to make certain car loans are appropriately protected and the borrower is absolutely qualified as well as will make the funding repayments.Broker Payment A mortgage broker represents the consumer extra than the lending institution. His responsibility is to obtain the borrower the ideal deal feasible, regardless of the establishment. He is normally paid by the financing, a type of commission, the distinction between the price he obtains from the borrowing organization and the rate he gives to the consumer.

Not known Facts About Broker Mortgage Fees

Jobs Defined Recognizing the pros and cons of each could assist you make a decision which career path you wish to take. According to, the main difference between both is that the bank home loan officer stands for the products that the bank they work for deals, while a mortgage broker deals with several lending institutions as well as acts as a middleman in between the lenders as well as client.On the other hand, bank brokers might find the task ordinary eventually since the process typically remains the same.

The Facts About Mortgage Brokerage Uncovered

What Is a Funding Policeman? You may understand that locating a financing police officer is a vital action in the process of acquiring your finance. Allow's review what financing officers do, what expertise they require to do their job well, and whether car loan officers are the most effective choice for customers in the loan application testing process.

Getting The Mortgage Broker Association To Work

What a Car loan Officer Does, A finance officer works for a financial institution or independent lending institution to assist customers in using for a loan. Considering that several customers collaborate with loan officers for home loans, they are commonly referred to as home mortgage lending officers, however many lending officers help debtors with various other car loans too.A car loan officer will consult with you as well as review your creditworthiness. If a car loan officer thinks you're eligible, then they'll advise you for approval, and also you'll have the ability to advance in the procedure of obtaining your car loan. 2. What Loan Police Officers Know, Lending police officers should have the ability to collaborate with customers and little company owners, and also they need to have considerable knowledge about the sector.

Unknown Facts About Broker Mortgage Near Me

Just How Much a Funding Policeman Costs, Some financing officers are paid through compensations link (broker mortgage calculator). Mortgage financings often tend to result in the biggest compensations due to the fact that of the dimension as well as workload linked with the finance, but commissions are typically a negotiable pre paid charge.Loan policemans know all regarding the many kinds of loans a loan provider may supply, as well as they can offer you recommendations regarding the best option for you and your circumstance. Discuss your demands with your lending additional resources policeman. They can assist route you toward the most effective financing type for your situation, whether that's a standard loan or a big lending.

Indicators on Broker Mortgage Rates You Should Know

2. The Function of a Funding Police Officer in the Testing Refine, Your lending policeman is your straight contact when you're using for a finance. They will look into and examine your economic history and also evaluate whether you get approved for a home mortgage. You will not have to fret about consistently calling all individuals included in the home mortgage car loan process, such as the expert, realty agent, settlement attorney as well as others, since your lending policeman will certainly be the factor of contact for all of the included celebrations.Due to the fact that the process of a car loan purchase can be a complicated as well as pricey one, lots of customers choose to deal with a human being instead of a computer system. This is why financial institutions may have several branches they intend to serve the prospective customers in various locations who wish to fulfill face-to-face with a loan police officer.

Not known Incorrect Statements About Mortgage Broker Average Salary

The Function of a Car Loan Police officer in the Financing Application Process, The home loan application procedure can really feel frustrating, especially for the new buyer. When you function with the right funding policeman, the procedure is really rather simple. When it concerns making an application for a mortgage, the process can be damaged down into six phases: Pre-approval: This is the phase in which you discover a loan policeman as well as obtain pre-approved.Throughout the finance handling phase, your lending officer will call you with any kind of inquiries the finance cpus may have about your application. Your funding policeman will certainly after that pass the application on to the underwriter, that will certainly analyze your credit reliability. If the expert accepts your car loan, your funding police officer will certainly after that accumulate as well as prepare the proper finance shutting files.

The Best Strategy To Use For Mortgage Broker Association

So exactly how do you pick the ideal funding police officer for you? To start your search, begin with lenders who have a superb reputation for surpassing their consumers' assumptions and preserving market requirements. Once published here you've chosen a lender, you can after that start to tighten down your search by talking to funding policemans you may desire to work with (broker mortgage rates).

Report this wiki page